OPERS and Medicare

Medicare coverage

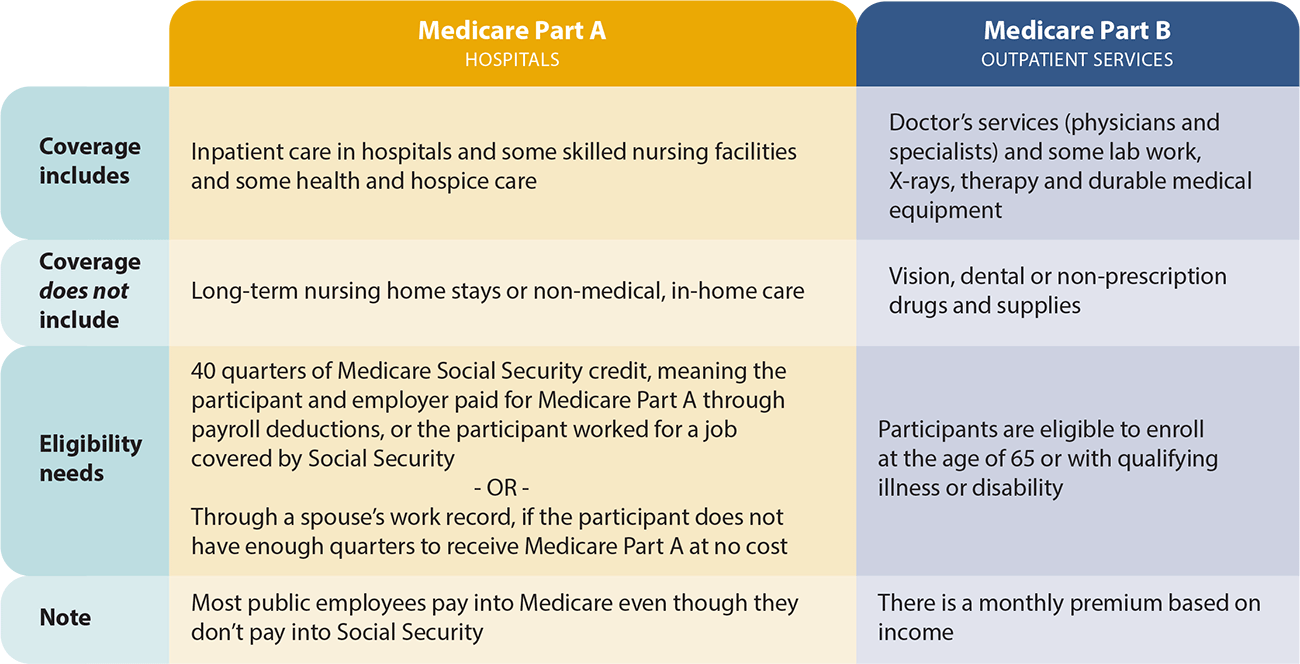

Medicare is federal health insurance for people age 65 and older, under age 65 with certain disabilities, and any age with End-Stage Renal Disease or ESRD (permanent kidney failure requiring dialysis or kidney transplant). Medicare costs vary depending on plan, coverage and the services used.

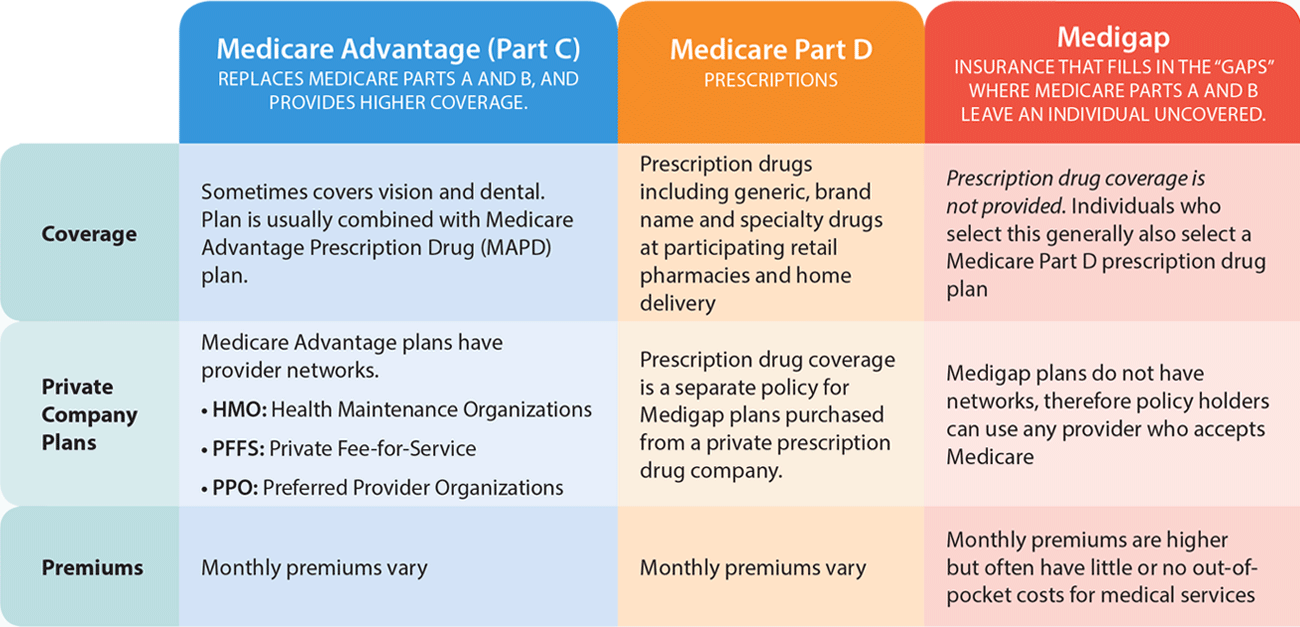

As an OPERS benefit recipient, you must enroll in both Medicare Parts A and B as soon as you become eligible. Once enrolled, you will select a Medicare Advantage plan or a Medigap plan (Medicare Supplement) and a Medicare D prescription drug plan using the OPERS Connector. Please note that most Medicare Advantage plans have prescription coverage included so you may not need to enroll in a separate Part D plan. During your enrollment appointment with Via Benefits, a Licensed Benefit Advisor will walk you through the plan selection process.

Medicare Part A Reimbursement

Public employees hired prior to April 1986 were not required to pay Medicare tax through their public employer. If you did not pay this tax during your public employment career, you do not have access to Medicare Part A without paying a monthly premium. Ohio law allows OPERS to provide premium reimbursement to those who are not eligible for premium-free Medicare Part A. As a Medicare-eligible OPERS benefit recipient, you are required to enroll in and pay the monthly premium for Medicare Part A coverage through the Centers for Medicare and Medicaid Services.

You will be responsible for repaying OPERS the amount OPERS reimbursed you if any of the following occur:

You are receiving reimbursement for yourself:

- If you disenroll or fail to pay your Medicare Part A premium to the Centers for Medicare and Medicaid Services.

- You disenroll from your medical plan through the OPERS Medicare Connector.

- If the premium amount changes or you no longer pay a premium. Please notify OPERS immediately by submitting the Notice of Award or other documentation from Social Security that states the new amount and date the new amount went into effect (other than a premium bill).

If you are receiving reimbursement for your spouse:

- If your spouse disenrolls or fails to pay their Medicare Part A premium to the Centers for Medicare and Medicaid Services.

- Your spouse disenrolls from their medical plan through the OPERS Medicare Connector and/or you disenroll from your medical plan through the OPERS Medicare Connector or opt out of receiving the Pre-Medicare HRA.

- If the premium amount changes or your spouse no longer pays a premium. Please notify OPERS immediately by submitting the Notice of Award or other documentation from Social Security that states the new amount and date the new amount went into effect (other than a premium bill).