Member-Directed Plan Educational Resources for the Member-Directed Plan

We offer a number of tools and resources to help you to take an active role and stay educated throughout your career so you can be prepared for retirement.

Our recorded presentations are updated regularly and tailored to your specific needs throughout your career.

Looking for more information on a specific topic? Then check out our informational leaflet series or comprehensive Member Handbook, all available in the Member Library.

Jump to:

Interactive Tools

myOrangeMoney Tool

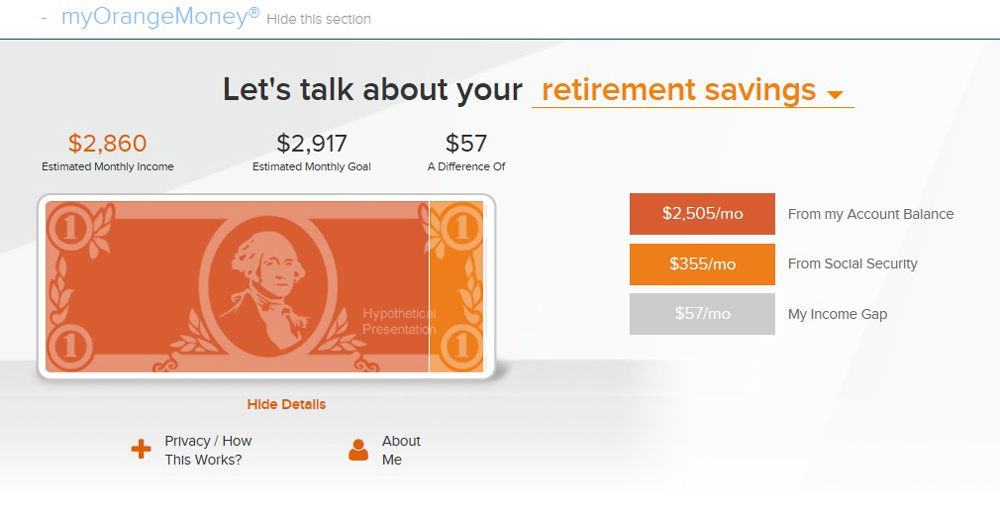

Voya's myOrangeMoney tool has been tailored specifically for OPERS members. The tool allows you to get an idea of what your retirement account will look like in the future and compare your estimated monthly income with what you think you may need in retirement.

Certain factors such as annuity factors and contribution rates have been customized for your plan.

You can access the tool through your online account.

Financial Wellness Experience Tool

Voya's Financial Wellness Experience tool is an online program which incorporates the myOrangeMoney tool and covers five financial areas:

- Protection

- Saving and spending

- Emergency funds

- Managing debt

- Other savings goals

The Financial Wellness Experience tool includes an interactive assessment that offers you a comprehensive understanding of where you are financially and what they can do about it. After taking a quick assessment, you'll get a personalized dashboard with guidance and educational content to help you focus on the areas where you could use improvement to move toward a healthier financial future.

You can access the tool through your online account.

Webinars

Bridging the Gap to Retirement Income

The goal of this webinar is to help you assess your financial wellness, review your current spending habits and estimate your retirement income so you can identify the "gap" between what you will have in retirement and what you will need. We'll also show you ways you can begin closing your gap today. To learn more and register click here

Recorded Presentations

- Managing Your Defined Contribution Account

- Self-Directed Brokerage Account

- Target Date Funds Video (video opens in new tab)

- Refunding From the Member-Directed Plan (link opens in new tab)

- Retiring from the Member-Directed Plan (link opens in new tab)

- Blackrock LifePath Brochure (link opens in new tab)

- Blackrock top 5 FAQs (link opens in new tab)

- Investment Funds Profiles

Learn More About Your Investment Options

Your account value in the Member-Directed Plan or the defined contribution portion of your Combined Plan is not a guaranteed amount. It is dependent on the performance of the investment options you select.